Paul B Insurance Can Be Fun For Anyone

It is very important to note that this extensive degree of protection is over and also past your standard responsibility insurance. So you leave to your vehicle in the early morning, and your auto is still there, but the window is broken. Possibly you have a car with a hand-operated transmission and also the thieves could not drive stick, so they pursued your possessions instead.

It depends what those points were, where they lay in the automobile, as well as how they were used by the proprietor. If you had belongings in the cars and truck, such as cellular phone, CDs, a purse, and so on, these products are covered under the personal effects area of your home owners insurance, condominium insurance policy, or tenants insurance coverage.

Paul B Insurance Fundamentals Explained

Yet even if these components are now on your automobile, it does not imply they are covered with each other under the exact same plan."Your standard stereo is covered under the vehicle plan if it is taken in the center of the evening," says Blais. "And also even many aftermarket systems are covered."The rationale is that, theoretically, a lot of late-model cars and trucks have advanced stereo, and also also the aftermarket devices are on-par with the supply ones.

Otherwise, you will just be made up for the worth of the supply wheels as well as tires. Do insurance coverage rates increase after I file a case? When you sue, your automobile insurance prices will likely go up. Just how much they go up will rely on various factors, such as: The type of case Just how much was paid on the case That was at mistake Your previous cases background Your driving document The insurance provider For example, you might not see a rate boost after a tiny windshield fixing, yet if you are submitting a second accident case or got a significant web traffic offense for causing a mishap, after that you can see a substantial increase.

Even if there is no legal reason for you to maintain your plan, there are benefits for doing so. Several insurance firms see a lapse in insurance coverage as a threat. When it's time to strike the roadway again, you may need to purchase nonstandard automobile insurance policy and pay higher premiums.

Paul B Insurance for Beginners

If you're not mosting likely to be driving, it's a good idea to contact your insurance policy representative to see what choices you have. They may be able to assist you change your plan and lower your costs till you lag the wheel once again. Compare Auto Insurance Quotes, Secure free personalized quotes with one simple form.

United State Information 360 Evaluations takes an objective technique to our recommendations. When you use our web links to acquire products, we might make a commission yet that in no means impacts our content freedom.

Insurance policy uses and the to establish the cost of insurance policy costs it charges customers based on different risk aspects. The rate should be sufficient for the firm to pay insurance claims in the future, pay its expenditures, and make a reasonable earnings, but not a lot to transform away customers. The most likely an event will occur for an offered client, the a lot more insurance provider will require to collect to pay the expected cases.

3 Easy Facts About Paul B Insurance Described

The price companies bill for insurance policy coverage goes through federal government policy. Insurer may not discriminate against candidates or insureds based upon an aspect that does not directly relate to the possibility of a loss taking place.

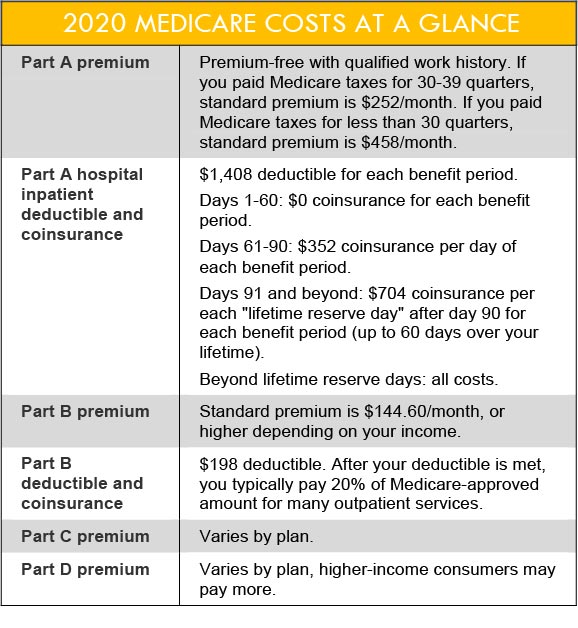

Medical insurance is necessary to have, however it's not constantly very easy to understand. You might have to take a few steps to make sure your insurance coverage will certainly spend for your healthcare costs. There are additionally a whole lot of key words and expressions to maintain right in your head. Below's some fundamental information you require to understand:Health and wellness insurance coverage assists pay for your health and wellness treatment.

It likewise covers numerous preventive solutions to maintain you healthy and balanced. You pay a month-to-month expense called a costs to get your medical insurance and also you may have to pay a section of the expense of your care each time you receive medical solutions. Each insurance coverage company has different regulations for utilizing healthcare benefits.

The 5-Minute Rule for Paul B Insurance

In basic, you will certainly offer your insurance policy details to your doctor or health center when you go for treatment. Your insurance policy card verifies that you have health and wellness insurance.

Your card is also convenient when you have questions about your wellness coverage. The contracts spell out what they will certainly be paid for the treatment they give.

Some insurance policy plans will certainly not pay anything if you do not Full Report use a network company (except when it comes to an emergency situation). So it is vital to seek advice from the plan's network prior to looking for care. You can call your insurance coverage firm utilizing the number on your insurance card. The firm will certainly inform you the doctors as well as medical facilities in your location that are part of their network.

What Does Paul B Insurance Mean?

Everyone with medical insurance need to have a physician who will manage their healthcare. That indicates you will require to discover a medical professional-- additionally called your primary treatment physician-- that is tackling new patients. If you have young kids, you will require to locate a pediatrician or family medicine medical professional for their care.

For example, you can go there to obtain stitches for a negative cut or to be inspected if you have a high fever. Call your insurance coverage company first to make certain it will spend for therapy there. Your read insurance coverage might likewise cover care at a retail-based clinic like the ones at huge shops with pharmacies.

Before going to a walk-in center, check with your insurance firm to make certain they will certainly pay for any type of care you obtain there.

The smart Trick of Paul B Insurance That Nobody is Discussing